|

The Labor Day festivities are behind us, this means that the holiday season is quickly approaching (I can hear Andy Williams' "It's the Most Wonderful Time of the Year" music fading in). If you are a small business owner who hates writing that check to the IRS, this year's tax planning season could be merrier than ever due to the changes brought about with the Tax Cuts and Jobs Act (TCJA). This is the time for ALL small business owners and entrepreneurs to start doing true tax planning. The TCJA is virtually a once in a lifetime opportunity for smart small businesses to use tax planning in a way that will ensure they don't lose their hard earned dollars. One key area that we have focused on is the Section 199A Qualified Business Income (QBI) rules, paying close attention to the recent developments from the IRS. There has not been this much change in the tax code since 1986 and it is important for small business owners and entrepreneurs to make the most of this opportunity to save money. One way to save money is to know how to navigate the new Section 199A Qualified Business Income (QBI) rules and we have completed our presentation for small businesses and entrepreneurs. Qualified Business Income is a "new" kind of income that is recognized differently than other types (ordinary, investment, passive) and small businesses need to know how it will affect their bottom line. There is a method to madness behind the change and we take a deeper dive in the presentation. For now check out the video below to get a definition of what QBI is and what income is subject to it. Join us in the coming months on one of our webinar presentations on QBI and other tax planning topics before tax planning season is in the rear-view mirror.

0 Comments

Recently the IRS released "Notice 2018-64" regarding the new Qualified Business Income (QBI) 20% deduction. Now I won't go into great details regarding the notice, but it basically provides small businesses with a method for calculating W-2 wages for the purposes of determining if a small business qualifies for QBI. The notice outlines the regulations and specifies which business types qualify for the deduction. These regulations are proposed regulations (may be subject to change) and tax payers and professionals will need to rely on this guidance until final regulations are published. The new QBI regulations will affect a great deal of small business owners in more ways than one. Some questions that small business owners need to address include:

We are currently developing a presentation that will go into greater detail regarding the QBI deduction and what you need to do as a small business owner to protect your hard earned dollars.  Had another great time meeting the many small business author/entrepreneurs in the local area this past weekend at the Atlanta Professional Business Network (APBN) Authors Showcase. After talking with many of the participants and fellow authors, I have compiled some key takeaways from the event.

The recently signed Bipartisan Budget Act of 2018 had a few tax extenders that are retroactive to 2017. some of the more notable provisions include: Exclusion for discharge of indebtedness on a principal residence The provision extends the exclusion from gross income of a discharge of qualified principal residence indebtedness through 2017. The provision also modifies the exclusion to apply to qualified principal residence indebtedness that is discharged pursuant to a binding written agreement entered into in 2017. Premiums for mortgage insurance (PMI) deductible as mortgage interest The provision extends the treatment of qualified mortgage insurance premiums as interest for purposes of the mortgage interest deduction through 2017. This deduction phases out ratably for taxpayers with adjusted gross income of $100,000 to $110,000. Above-the-line deduction for qualified tuition and related expenses The provision extends the above-the-line deduction for qualified tuition and related expenses for higher education through 2017. The deduction is capped at $4,000 for an individual whose adjusted gross income (AGI) does not exceed $65,000 ($130,000 for joint filers) or $2,000 for an individual whose AGI does not exceed $80,000 ($160,000 for joint filers). Three-year depreciation for race horses 2-years-old or younger The provision extends the 3-year recovery period for race horses to property placed in service during 2017. Contact us if you have already filed your return and qualify for these tax extender provisions. Happy New Year! With the start of 2018, we have fielded a great deal of questions regarding the Tax Cuts and Jobs Act. We figured we would put out a short post to address the most important ones

1. When will the tax changes take effect? The bill takes effect on January 1, 2018, thus when you file your 2018 taxes (in 2019) you will see the results of the tax changes. W-2 employees will see changes in their paychecks federal withholding in February 2018. 2. How much will the tax changes save a taxpayer? The short answer is, it depends...what your total income is and where your income is derived. Also other factors can play a role in determining how much you will save. 3. Do I need to do anything to change my withholding? According to the IRS regarding withholding changes: “We anticipate issuing the initial withholding guidance in January, and employers and payroll service providers will be encouraged to implement the changes in February,” said the IRS. “The IRS emphasizes this information will be designed to work with the existing Forms W-4 that employees have already filed, and no further action by taxpayers is needed at this time.” These are just a few of the top questions we are hearing from taxpayers, feel free to contact us if you have any questions regarding the Tax Cut and Jobs Act. It was great to be a part of the Atlanta Professional Business Network (APBN) Author's Showcase this past weekend at the Mechanicsville Library. With over 20 local authors, the event provided a great opportunity to meet current and aspiring authors. Authors, speakers and coaches that sell books and speaking engagements also need to keep track of their sales and expenses and that is where we can assist (with the tips included in the book of course). It was a great time to network with them and provide insights into saving their hard earned dollars and working more efficiently.

Pictures from the event below... Great to see and fellow tech driven accountants and consultants and network before the year-end!

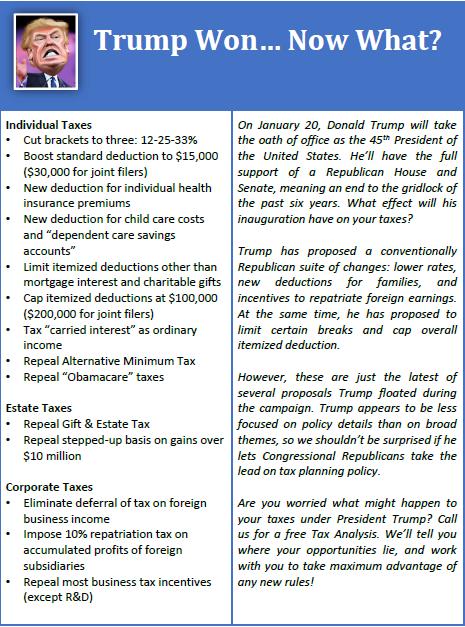

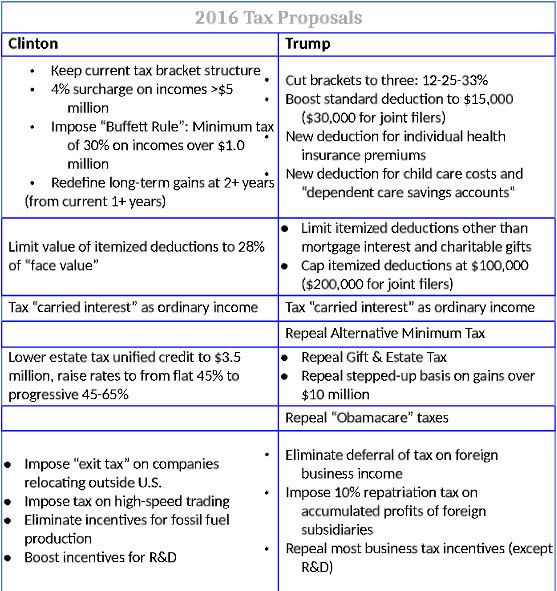

Get a head start prepping for a new year by taking a look at changing your accounting systems. Speak with us to start the conversation on conversions and learn how we have successfully – and thankfully – switched our clients to cloud accounting solutions. Be sure to contact us if you are a small business owner/entrepreneur that needs end of the year assistance. With just a few days left to go out and vote, here are the tax proposals for the two leading candidates.

In honor of The Masters golf tournament this week, here is a tax tip that can save you a couple of strokes off your tax bill. It's the good old "Augusta Rule" (Section 280A(g) of the Internal Revenue Code) in honor of the residents of Augusta, Georgia who rent their homes to spectators visiting The Masters. Great thing is you don't have to be in Augusta to take part in this tax break. You’ll also see residents of Super Bowl host cities, political convention sites, music festivals, and Olympic Games host cities take advantage of the rule. And many taxpayers who live in less exotic locations take advantage of the opportunity to rent out their vacation homes when they would otherwise sit empty. However, this rule also opens the door to renting your home to your business, paying a reasonable deductible rent out of the business account, and then treating it as non-taxable income when it hits your personal account. You can rent your home for all sorts of purposes, including business meetings, employee events, and even a limited amount of employee entertainment. The key to making this work is to document your bona fide use of the home, and show that the rent you charge is reasonable. Need help feel free to contact us. |

AuthorVarious contributors Archives

December 2023

Categories

All

|

RSS Feed

RSS Feed