The Internal Revenue Service has modified its “first time abate” or (FTA) policy, which provides a one-time consideration of penalty relief, based on the taxpayer’s compliance history. The FTA penalty relief option for failure to file, failure to pay and failure to deposit penalties, under certain conditions, does not apply if the taxpayer has not filed all returns and paid, or arranged to pay, all tax currently due. For example, the taxpayer is considered current if they have an open installment agreement and are current with their installment payments. The FTA relief only applies to a single tax period for a taxpayer, and penalty relief under the first time abatement provision does not apply to returns with an event-based filing requirement. Additionally the FTA relief does not apply to the following type returns if a previously filed return was late:

Feel free to contact us if you need assistance with a tax penalty abatement or proactive tax planning.

0 Comments

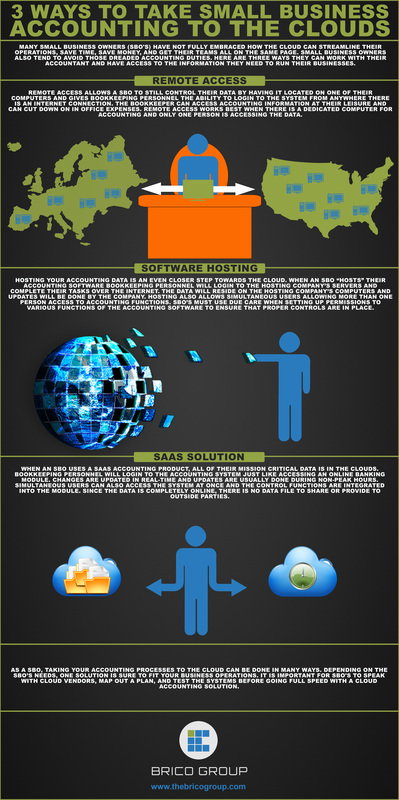

Small business owners that are hearing a great deal about the cloud lately may not have all the facts when it comes to accounting in the cloud. Here is an infographic we created to outline the three major ways to take your accounting to the clouds.

|

AuthorVarious contributors Archives

January 2024

Categories

All

|

RSS Feed

RSS Feed