The recently signed Bipartisan Budget Act of 2018 had a few tax extenders that are retroactive to 2017. some of the more notable provisions include: Exclusion for discharge of indebtedness on a principal residence The provision extends the exclusion from gross income of a discharge of qualified principal residence indebtedness through 2017. The provision also modifies the exclusion to apply to qualified principal residence indebtedness that is discharged pursuant to a binding written agreement entered into in 2017. Premiums for mortgage insurance (PMI) deductible as mortgage interest The provision extends the treatment of qualified mortgage insurance premiums as interest for purposes of the mortgage interest deduction through 2017. This deduction phases out ratably for taxpayers with adjusted gross income of $100,000 to $110,000. Above-the-line deduction for qualified tuition and related expenses The provision extends the above-the-line deduction for qualified tuition and related expenses for higher education through 2017. The deduction is capped at $4,000 for an individual whose adjusted gross income (AGI) does not exceed $65,000 ($130,000 for joint filers) or $2,000 for an individual whose AGI does not exceed $80,000 ($160,000 for joint filers). Three-year depreciation for race horses 2-years-old or younger The provision extends the 3-year recovery period for race horses to property placed in service during 2017. Contact us if you have already filed your return and qualify for these tax extender provisions.

1 Comment

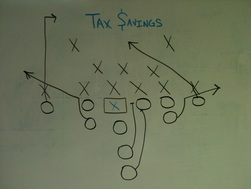

If procrastination were the Super Bowl, many small business owners (SBO's) would have multiple "Lombardi" trophies. Time to put away those whites (unless you are Billy "White Shoes" Johnson) and pull out the ole playbook of late summer early fall tax planning ideas. Just like the start of the NFL football season brings teams a new playbook, SBO's need to update their tax strategy playbooks now to ensure that they will be ready for the tax planning season starting now. Most SBO's can take a look at their previous season's record to give them an idea of how good their tax playbook was and where they need to be this year. If you have not "completed the 2013 tax season" yet, here are some of the more important "game" dates in the coming months where many SBO's can complete the 2013 tax season. • September 15th - Tax extension deadline for C-Corps, S-Corps and Partnerships • October 15th - Tax extension deadline for personal tax returns • December 31st - Final day of tax planning for 2014 season If you have completed the 2013 tax, great, but this is not the time to sit back on your laurels! Time is now to focus on new tax plays for the 2014 season. The tax league’s “Front Office” is making quite a few rule changes this year that may make it difficult for SBO’s to score many tax savings touchdowns (expiring tax provisions for SBO’s), but the basic rules are still in effect. Since the season is shorter than the NFL one, tax planning is key to saving your small business thousands. Using legal "black letter" tax strategies in your playbook will ensure you have a winning record this season. Need help devising your tax strategy playbook, feel free to contact us.

2013 has been a big year for taxes. Earlier in the year, Congress passed legislation averting the so-called "fiscal cliff," and many of the "Obamacare" changes have taken effect, or are about to. While few of us who watched the process would consider it Washington's finest hour, we now have answers to many of the questions that have made proactive planning so difficult over the past few years. And now, with just 20 days left in 2013, it's time to review the "deals" the IRS is offering and start to plan. Here are the highlights: • First, the Bush tax cuts are permanently extended for income up to $400,000 ($450,000 for joint filers). Ordinary income above those thresholds is taxed at 39.6%, while qualified corporate dividends and long-term capital gains above those thresholds are taxed at 20%. • Next, the 2% payroll tax "holiday" of 2011-2012 is over. This can mean over $2,000 in additional tax for those earning over $100,000 per year. • Third, the Alternative Minimum Tax has finally been indexed for inflation. This means Congress will no longer have to "patch" it every year to avoid entangling millions more taxpayers in its web. • Finally, the Medicare tax provisions of the Affordable Care Act, or "Obamacare," have taken effect. This means an extra 0.9% tax on earned income above $250,000 and a 3.8% tax on investment income for taxpayers earning more than $200,000 ($250,000 for joint filers). President Obama has called for slashing several more tax breaks, possibly including some sacred cows like mortgage interest. However, after the recent government shutdown, there appears to be little appetite on Capitol Hill for further changes to the code. With just 20 days left in until the “IRS Holiday Tax Sale” ends join us here to review some specific strategies for minimizing your tax under the new rules. |

AuthorVarious contributors Archives

January 2024

Categories

All

|

RSS Feed

RSS Feed