Ironically, the 2023 tax season starts today on January 23rd. Another year of putting the correct numbers in the correct boxes and filing by the correct due date. Those numbers however, have a greater emotional meaning to you the taxpayer. Numbers such as total income can drag your ego and pride into the mix when you have a banner year. It makes for an exciting yet stressful situation when you have a great year but did not plan accordingly. Will I owe taxes on the income or will I be able to minimize my tax burden are the questions revolving around in your head. Did I make a tax plan ahead of time to address the increase in income? When you are only putting the correct numbers in the correct boxes by the correct due date, you are selling yourself short and possibly leaving your hard earned dollars to the IRS. The goal is to bring those numbers to life, recognize them and celebrate them. What better way to accomplish this than by building a tax plan during the year so there are no surprises at tax time. Feel free to contact us if you would like to partner with more than a tax professional that puts the right numbers in the right boxes by the right due date to build a lasting relationship to save your hard earned dollars and bring meaning to your numbers. Here's to a less "taxing" filing season.

0 Comments

According to a recent study by Allianz Life Insurance, 54% of American workers have cut or stopped their retirement contributions to combat the rising prices of inflation. With inflation being at a 40-year high, many taxpayers are also taking early withdrawals from those same accounts to make ends meet. Inflation can affect a great deal of decisions for taxpayers including when to make tax payments. If the IRS underpayment rate is lower than the US inflation rate, it may pay to wait until a later date with dollars that are worth considerably less. Those same tax dollars could be used for many other things including charity, real estate strategies or other retirement planning. If you need any assistance with tax planning for inflation, feel free to give us a call. #inflation #taxes #taxplanning #intheblack Itemized deductions versus the standard deduction

The TCJA doubles the standard deduction, but suspends the personal exemptions and virtually eliminates many of the itemized deductions. The law temporarily eliminates miscellaneous itemized deductions subject to the 2 percent floor and limits the home mortgage interest deduction to home acquisition debt of up to $750,000. With these changes, some taxpayers may see a lower taxes. Some taxpayers that itemized in the past may not for 2018. Contact us is you need to run the numbers for your tax situation. If the results are grim, you may need to adjust your employer withholding (Form W-4) and/or quarterly estimated tax payments. Bunch charitable contributions The TCJA temporarily increases the limit of cash contributions to public charities from 50 to 60 percent of adjusted gross income (AGI). The only problem (as mentioned above) is that the double standard deduction and itemized changes will leave many taxpayers left out. One solution is to bunch or increase charitable contributions in alternating years, or set up donor-advised funds. Watch out for home equity debt interest The TCJA allows for home equity debt interest if the funds were used to buy or substantially improve the home that secures the loan. Taxpayers must keep good records to ensure that the proceeds were used in this manner, payment to credit card or other personal debt is not allowed (even if prior to 2018). Revisit 529 qualified tuition plans The TCJA revises earnings in a 529 college savings plan and allows for paying tuition at an elementary or secondary public, private or religious school, up to $10,000 per year. If you fall in this boat, it may be time to revisit their 529 plans. Maximize the qualified business income deduction And of course last but not least the QBI deduction (from our last post) for small business owners. Be sure to contact us for steps how this deduction can save your hard earned dollars The Labor Day festivities are behind us, this means that the holiday season is quickly approaching (I can hear Andy Williams' "It's the Most Wonderful Time of the Year" music fading in). If you are a small business owner who hates writing that check to the IRS, this year's tax planning season could be merrier than ever due to the changes brought about with the Tax Cuts and Jobs Act (TCJA). This is the time for ALL small business owners and entrepreneurs to start doing true tax planning. The TCJA is virtually a once in a lifetime opportunity for smart small businesses to use tax planning in a way that will ensure they don't lose their hard earned dollars. One key area that we have focused on is the Section 199A Qualified Business Income (QBI) rules, paying close attention to the recent developments from the IRS. There has not been this much change in the tax code since 1986 and it is important for small business owners and entrepreneurs to make the most of this opportunity to save money. One way to save money is to know how to navigate the new Section 199A Qualified Business Income (QBI) rules and we have completed our presentation for small businesses and entrepreneurs. Qualified Business Income is a "new" kind of income that is recognized differently than other types (ordinary, investment, passive) and small businesses need to know how it will affect their bottom line. There is a method to madness behind the change and we take a deeper dive in the presentation. For now check out the video below to get a definition of what QBI is and what income is subject to it. Join us in the coming months on one of our webinar presentations on QBI and other tax planning topics before tax planning season is in the rear-view mirror.  Recently the IRS released "Notice 2018-64" regarding the new Qualified Business Income (QBI) 20% deduction. Now I won't go into great details regarding the notice, but it basically provides small businesses with a method for calculating W-2 wages for the purposes of determining if a small business qualifies for QBI. The notice outlines the regulations and specifies which business types qualify for the deduction. These regulations are proposed regulations (may be subject to change) and tax payers and professionals will need to rely on this guidance until final regulations are published. The new QBI regulations will affect a great deal of small business owners in more ways than one. Some questions that small business owners need to address include:

We are currently developing a presentation that will go into greater detail regarding the QBI deduction and what you need to do as a small business owner to protect your hard earned dollars.  Had another great time meeting the many small business author/entrepreneurs in the local area this past weekend at the Atlanta Professional Business Network (APBN) Authors Showcase. After talking with many of the participants and fellow authors, I have compiled some key takeaways from the event.

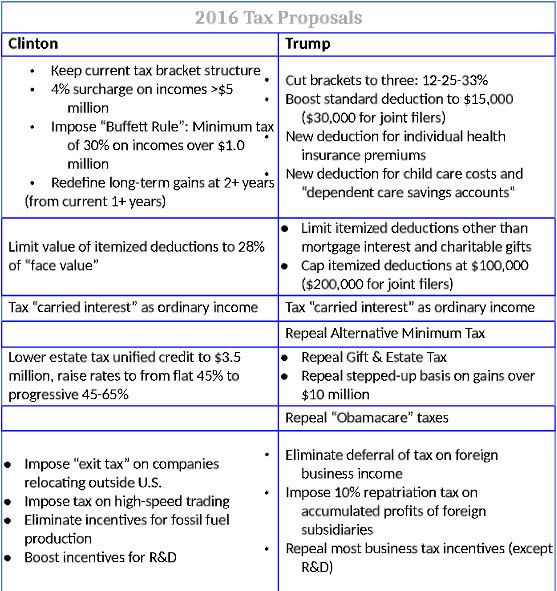

The recently signed Bipartisan Budget Act of 2018 had a few tax extenders that are retroactive to 2017. some of the more notable provisions include: Exclusion for discharge of indebtedness on a principal residence The provision extends the exclusion from gross income of a discharge of qualified principal residence indebtedness through 2017. The provision also modifies the exclusion to apply to qualified principal residence indebtedness that is discharged pursuant to a binding written agreement entered into in 2017. Premiums for mortgage insurance (PMI) deductible as mortgage interest The provision extends the treatment of qualified mortgage insurance premiums as interest for purposes of the mortgage interest deduction through 2017. This deduction phases out ratably for taxpayers with adjusted gross income of $100,000 to $110,000. Above-the-line deduction for qualified tuition and related expenses The provision extends the above-the-line deduction for qualified tuition and related expenses for higher education through 2017. The deduction is capped at $4,000 for an individual whose adjusted gross income (AGI) does not exceed $65,000 ($130,000 for joint filers) or $2,000 for an individual whose AGI does not exceed $80,000 ($160,000 for joint filers). Three-year depreciation for race horses 2-years-old or younger The provision extends the 3-year recovery period for race horses to property placed in service during 2017. Contact us if you have already filed your return and qualify for these tax extender provisions. With just a few days left to go out and vote, here are the tax proposals for the two leading candidates.

The dog days of summer are in full swing and that typically means spending relaxing hours by the pool with friends and family, not thinking about the stresses of running your business. Before you know it though, those relaxing days by the pool will come to an end and it will be back to business. There are a number of ways you can turn some of that summertime fun into immediate tax savings for your business and family. Here are a few:

These are just a few ways that you can turn your summertime activities into immediate tax savings. Have questions about how; feel free to contact us for time is running out. Just like a sun tanner that stays out in the sun too long, you can get burned if you don't put a tax plan together soon.  If you’re like most small business owners (SBO's), you qualify for all sorts of valuable tax credits and deductions, not to mention additional strategies that could lower your tax bill. But if you (or your tax professional) aren’t looking out for them, you may be losing your share. Now that tax season is over, you should review your tax return for the following: Do I feel that I paid too much tax (or refund was too small)? Did my small business take all the legal credits and deductions this year? What strategies can I use to lower my tax in the future? Many small business owners (SBO's) think that now that tax season is over they can tuck those tax returns away and get back to the more exciting, less stressful tasks in their businesses. Don't put away those tax returns just yet (especially if you feel you paid more tax than you should have). After tax season is a great time to review your tax returns for potential tax savings that you can implement right now. Most SBO's don't realize that every action they take in their business during the year has a real effect on their bottom line. Some of the many deductions and credits a SBO may qualify for include:

These are just a few of the questions SBO's should be asking in the "off" season to ensure that they keep more of their hard earned dollars. Feel free to contact us regarding your assets, health care, or entity selection changes you would like to make before year end. The clock is ticking... |

AuthorVarious contributors Archives

January 2024

Categories

All

|

RSS Feed

RSS Feed