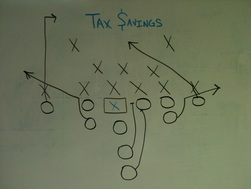

If procrastination were the Super Bowl, many small business owners (SBO's) would have multiple "Lombardi" trophies. Time to put away those whites (unless you are Billy "White Shoes" Johnson) and pull out the ole playbook of late summer early fall tax planning ideas. Just like the start of the NFL football season brings teams a new playbook, SBO's need to update their tax strategy playbooks now to ensure that they will be ready for the tax planning season starting now. Most SBO's can take a look at their previous season's record to give them an idea of how good their tax playbook was and where they need to be this year. If you have not "completed the 2013 tax season" yet, here are some of the more important "game" dates in the coming months where many SBO's can complete the 2013 tax season. • September 15th - Tax extension deadline for C-Corps, S-Corps and Partnerships • October 15th - Tax extension deadline for personal tax returns • December 31st - Final day of tax planning for 2014 season If you have completed the 2013 tax, great, but this is not the time to sit back on your laurels! Time is now to focus on new tax plays for the 2014 season. The tax league’s “Front Office” is making quite a few rule changes this year that may make it difficult for SBO’s to score many tax savings touchdowns (expiring tax provisions for SBO’s), but the basic rules are still in effect. Since the season is shorter than the NFL one, tax planning is key to saving your small business thousands. Using legal "black letter" tax strategies in your playbook will ensure you have a winning record this season. Need help devising your tax strategy playbook, feel free to contact us.

0 Comments

2013 has been a big year for taxes. Earlier in the year, Congress passed legislation averting the so-called "fiscal cliff," and many of the "Obamacare" changes have taken effect, or are about to. While few of us who watched the process would consider it Washington's finest hour, we now have answers to many of the questions that have made proactive planning so difficult over the past few years. And now, with just 20 days left in 2013, it's time to review the "deals" the IRS is offering and start to plan. Here are the highlights: • First, the Bush tax cuts are permanently extended for income up to $400,000 ($450,000 for joint filers). Ordinary income above those thresholds is taxed at 39.6%, while qualified corporate dividends and long-term capital gains above those thresholds are taxed at 20%. • Next, the 2% payroll tax "holiday" of 2011-2012 is over. This can mean over $2,000 in additional tax for those earning over $100,000 per year. • Third, the Alternative Minimum Tax has finally been indexed for inflation. This means Congress will no longer have to "patch" it every year to avoid entangling millions more taxpayers in its web. • Finally, the Medicare tax provisions of the Affordable Care Act, or "Obamacare," have taken effect. This means an extra 0.9% tax on earned income above $250,000 and a 3.8% tax on investment income for taxpayers earning more than $200,000 ($250,000 for joint filers). President Obama has called for slashing several more tax breaks, possibly including some sacred cows like mortgage interest. However, after the recent government shutdown, there appears to be little appetite on Capitol Hill for further changes to the code. With just 20 days left in until the “IRS Holiday Tax Sale” ends join us here to review some specific strategies for minimizing your tax under the new rules.  By now, of course, you've heard that Congress has passed legislation avoiding the tax increases of the Fiscal Cliff. Here are the highlights: The Bush tax cuts are restored for income up to $400,000 ($450,000 for joint filers). Rates for income above those ceilings rises to 39.6% for ordinary income. Capital gains rate…or gains you earn from the sale of property that you’ve held for longer than a year increased to 20%. The key point here is that you don’t pay tax until you actually sell the property. Next, are “qualified corporate dividends.” The rate also is 20% Corporate dividends are also subject to the new “Unearned Income Medicare Contribution” that goes into effect on January 1. New rates on capital gains and qualified corporate dividends will make tax planning an even more important part of your overall financial planning. Back in 2010, Washington cut the payroll tax by 2%, for one year, on the employee side. This meant a savings of up to $2,136 for someone earning at or above the Social Security wage base. Earlier this year, Washington struggled to extend it through 2012. But as it stands now, that cut expires. And unfortunately, it looks like both sides are content to let that cut expire for good. The Alternative Minimum Tax, or AMT, is a parallel tax designed to prevent “the rich” from using regular deductions to avoid tax entirely. The Alternative Minimum Tax is finally indexed for inflation, meaning Washington won't need to "patch" it every year so about 33 million tax payers are safe. Next, the estate tax… The estate tax "unified credit" amount that you can bequeath tax-free remains at $5 million, indexed for inflation. The actual rate rises from 35% to 40%. The legislation also extends several popular tax breaks, like higher limits for business equipment expensing, deductions for student loan interest, and tax-free charitable gifts made directly from Individual Retirement Accounts. We realize you've already heard this news. But we want you to know we'll be studying the new law in the coming weeks and months to look for every opportunity to help you save. And of course, if you have any questions, don't hesitate to call us. |

AuthorVarious contributors Archives

January 2024

Categories

All

|

RSS Feed

RSS Feed