The recently signed Bipartisan Budget Act of 2018 had a few tax extenders that are retroactive to 2017. some of the more notable provisions include: Exclusion for discharge of indebtedness on a principal residence The provision extends the exclusion from gross income of a discharge of qualified principal residence indebtedness through 2017. The provision also modifies the exclusion to apply to qualified principal residence indebtedness that is discharged pursuant to a binding written agreement entered into in 2017. Premiums for mortgage insurance (PMI) deductible as mortgage interest The provision extends the treatment of qualified mortgage insurance premiums as interest for purposes of the mortgage interest deduction through 2017. This deduction phases out ratably for taxpayers with adjusted gross income of $100,000 to $110,000. Above-the-line deduction for qualified tuition and related expenses The provision extends the above-the-line deduction for qualified tuition and related expenses for higher education through 2017. The deduction is capped at $4,000 for an individual whose adjusted gross income (AGI) does not exceed $65,000 ($130,000 for joint filers) or $2,000 for an individual whose AGI does not exceed $80,000 ($160,000 for joint filers). Three-year depreciation for race horses 2-years-old or younger The provision extends the 3-year recovery period for race horses to property placed in service during 2017. Contact us if you have already filed your return and qualify for these tax extender provisions.

1 Comment

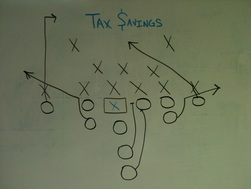

If procrastination were the Super Bowl, many small business owners (SBO's) would have multiple "Lombardi" trophies. Time to put away those whites (unless you are Billy "White Shoes" Johnson) and pull out the ole playbook of late summer early fall tax planning ideas. Just like the start of the NFL football season brings teams a new playbook, SBO's need to update their tax strategy playbooks now to ensure that they will be ready for the tax planning season starting now. Most SBO's can take a look at their previous season's record to give them an idea of how good their tax playbook was and where they need to be this year. If you have not "completed the 2013 tax season" yet, here are some of the more important "game" dates in the coming months where many SBO's can complete the 2013 tax season. • September 15th - Tax extension deadline for C-Corps, S-Corps and Partnerships • October 15th - Tax extension deadline for personal tax returns • December 31st - Final day of tax planning for 2014 season If you have completed the 2013 tax, great, but this is not the time to sit back on your laurels! Time is now to focus on new tax plays for the 2014 season. The tax league’s “Front Office” is making quite a few rule changes this year that may make it difficult for SBO’s to score many tax savings touchdowns (expiring tax provisions for SBO’s), but the basic rules are still in effect. Since the season is shorter than the NFL one, tax planning is key to saving your small business thousands. Using legal "black letter" tax strategies in your playbook will ensure you have a winning record this season. Need help devising your tax strategy playbook, feel free to contact us.

As the Independence Day 4th of July celebrations are being finalized for later this week, I got to thinking about the feeling I had as an entrepreneur the day I claimed independence from the typical route and set out on my own destiny. Being an entrepreneur can provide a person with the ability to be independent but that can be both an asset and a liability. On the one hand you get to make all the decisions. Many of those decisions are made however with either little to no knowledge of the situation or the effects of those choices made (especially in the early stages of a business). Typically when decisions are made in this manner, a setback (or as some would call it a learning experience) occurs. We have learned, from taking a look back at history, the main reason we celebrate Independence Day is due to the tax burden placed on American colonists by the British. Taxes have always caused many small business owners grief. In a recent report by Paychex, a leading payroll provider; 47% of small business owners ranked taxes as the largest issue impacting them in 2014. If that includes you, then now is the time to claim your tax independence. So in between the plates of hot dogs, ribs and watching the fireworks, download the "Tax Independence Survey" below and stop making the expensive tax mistakes that keep many entrepreneurs and small businesses worried about their tax future. The survey focuses on key areas of your life (business and personal) where there may be tax savings that you can use to celebrate more holidays (maybe Christmas in July) with your family. Then after the holiday contact us so we can begin implementing some of the tax strategies. We hope you have a safe and happy Independence Day 4th of July celebration.  With the Memorial Day holiday in the rearview mirror, many small business owners and entrepreneurs and busy planning their holiday vacations and many other summer activities. Another planning activity that really needs to be on every small business and entrepreneur’s list is tax planning. If you are like most small business owners and entrepreneurs, you waste thousands of dollars every year in taxes you don’t need to pay. You then grumble about it on April 15 . . . then wait until next year to get smacked again…you see a pattern here. The sad truth is, it doesn’t matter how good your tax accountant (let’s call him “Fully Depreciated Frank”) is with a stack of receipts on April 15. The key to beating the IRS is tax planning. The summer is a great time for tax planning. As a small business owner and entrepreneur, has “Fully Depreciated Frank” contacted you with answers to all of these questions?

If not, you need to go to Amazon and get our new book “Expensive Tax Mistakes That Cost Small Business Owners Thousands”. The book reveals the mistakes and missed opportunities that can cost you thousands in tax; then shows you how proactive tax planning can rescue those wasted dollars. Stop by Amazon now and stop making those expensive tax mistakes that make you hotter than the summer heat.  Many say that Friday the 13th is an unlucky day and today may be one of those days for taxpayers. It would appear that the IRS is playing the role of Jason Voorhees and are performing an all out massacre on the many tax deductions individuals and small business owners rely on to save money on their tax returns. Here are 13 (unlucky) tax deductions that the IRS will slaughter like Jason did the kids at Camp Crystal Lake by year end.

Don't want to be caught by the slashing machete of the IRS? Now is the time to put a plan in action so you will still be alive when the credits roll at the end of 2013. Time is ticking... See how much time you have left here. In an attempt to reduce the administrative, recordkeeping, and compliance burdens of taxpayers, the IRS has offered a safe harbor method to compute the allowable deduction for the business-use portion of the home. The safe harbor method is effective for taxable years beginning on or after January 1, 2013.

Under the safe harbor method, the taxpayer multiplies the allowable square footage of the home office by the prescribed rate of $5.00. The allowable square footage for business use cannot exceed 300 square feet; thus, the maximum allowable home office deduction under the safe harbor method is $1,500. The safe harbor deduction, cannot exceed the business income for the year reduced by business expenses unrelated to the dwelling unit. Any taxpayer using the safe harbor method may not carry over any disallowed safe harbor deductions to the next year. Other Provisions

|

AuthorVarious contributors Archives

January 2024

Categories

All

|

RSS Feed

RSS Feed