|

Great to see and fellow tech driven accountants and consultants and network before the year-end!

Get a head start prepping for a new year by taking a look at changing your accounting systems. Speak with us to start the conversation on conversions and learn how we have successfully – and thankfully – switched our clients to cloud accounting solutions. Be sure to contact us if you are a small business owner/entrepreneur that needs end of the year assistance.

0 Comments

There is a tax firm out there that can help their clients pay no income tax. This tax firm is comprised of a large work force that has access to all the necessary technology tools and tax information to ensure that their clients use all the legal loopholes to bring their tax liability to zero and many times a surplus. This tax firm is so good at saving their clients tax dollars that major accounting firms even loan their employees to them! Sounds like a great accounting right? Only one problem this accounting firm has one client...and that client is GE. GE's Tax department is one of the most prestigious tax firms in the country. A quick Google search of "GE Tax Department" shows the efforts that GE goes through to pay no taxes. Most small business owners don't have the resources and time to research the tax strategies like their "Big Boy" counterparts. They then go about taxes much the same way most personal taxpayers do, taking the last minute "SALY" approach. Learn more about "SALY" here. Approaching taxes as a routine is ok, if your routine is done on a consistent basis. But even a consistent routine has small changes. Take your morning routine for instance. You may get up at the same time every day, but is the same song playing when you wake, or do you have the same breakfast every morning? The same goes for your tax planning routine. There is a consistent guide that you follow, but you must always monitor for the changes. This includes staying up to date on tax changes, and how they affect your business decisions during the year.

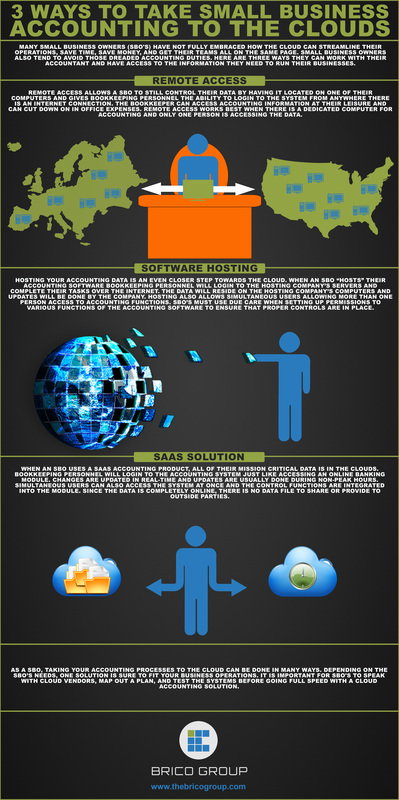

There are quite a few tax issues affecting small businesses currently. From the changes in depreciation, and deduction rules to healthcare now is the time to take advantage of tax strategies for main street businesses like yours. It's doesn't take having a large tax firm as your tax department to save your hard earned money, but it does take some work (with a little help from a tax expert friend like us :-). So do like "Nike" the Goddess of motivation/implementation and "just do it".  Operating a successful small business requires an innovative approach to your business, openness to change, and the ability to implement those changes. When a small business is in the “growth” stage, wearing the many hats can become difficult for the business owner leading the business. Most small business owners feel they need to be in every aspect of their business to ensure its continued success, however this thought process is not always the best course of action. Take accounting and bookkeeping for example. Many small business owners spend the majority of their time working in their businesses, that when it comes time to work on it (the accounting, bookkeeping stuff) they are exhausted from the work, source documents have been misplaced and other important information has been forgotten. Some business owners then chose the option of hiring a staff person to do the “grunt” work. Accounting is the foundation of any business. There is virtually no action you can do in your business without it creating an accounting transaction. From source document to financial statements and analysis, a small business owner needs the support of a capable, consistent, compliant partner. An outsourced accounting partner is the bridge to your small business success. Outsourcing your accounting provides you with the confidence that your financial records will be handled correctly from start to finish. You also will have a higher level of expertise for situations that require more than just “grunt” work, and your information can be processed faster with cloud technologies allowing you real-time access to your data. If you are a small business owner still struggling to keep up with the accounting and bookkeeping tasks in your business, then maybe it’s time to build a bridge to your success with outsourced accounting. Small business owners that are hearing a great deal about the cloud lately may not have all the facts when it comes to accounting in the cloud. Here is an infographic we created to outline the three major ways to take your accounting to the clouds.

|

AuthorVarious contributors Archives

January 2024

Categories

All

|

RSS Feed

RSS Feed