2013 has been a big year for taxes. Earlier in the year, Congress passed legislation averting the so-called "fiscal cliff," and many of the "Obamacare" changes have taken effect, or are about to. While few of us who watched the process would consider it Washington's finest hour, we now have answers to many of the questions that have made proactive planning so difficult over the past few years. And now, with just 20 days left in 2013, it's time to review the "deals" the IRS is offering and start to plan. Here are the highlights: • First, the Bush tax cuts are permanently extended for income up to $400,000 ($450,000 for joint filers). Ordinary income above those thresholds is taxed at 39.6%, while qualified corporate dividends and long-term capital gains above those thresholds are taxed at 20%. • Next, the 2% payroll tax "holiday" of 2011-2012 is over. This can mean over $2,000 in additional tax for those earning over $100,000 per year. • Third, the Alternative Minimum Tax has finally been indexed for inflation. This means Congress will no longer have to "patch" it every year to avoid entangling millions more taxpayers in its web. • Finally, the Medicare tax provisions of the Affordable Care Act, or "Obamacare," have taken effect. This means an extra 0.9% tax on earned income above $250,000 and a 3.8% tax on investment income for taxpayers earning more than $200,000 ($250,000 for joint filers). President Obama has called for slashing several more tax breaks, possibly including some sacred cows like mortgage interest. However, after the recent government shutdown, there appears to be little appetite on Capitol Hill for further changes to the code. With just 20 days left in until the “IRS Holiday Tax Sale” ends join us here to review some specific strategies for minimizing your tax under the new rules.

0 Comments

No IRS Black Friday deals today? No IRS Black Friday deals today? The day to give "Thanks" is behind us and the holidays are in full swing. Millions of Americans are kicking off the season with “Black Friday” shopping. Braving the crowds and the cold, facing scorn from family they’ve left behind, they line up at obscenely early hours (or duck out of Thanksgiving dinner before the pumpkin pie is even served) to save $20 on a iPad or $40 on a flat-screen television. It’s sad, but true, that most Americans spend more time planning their “Black Friday” shopping than they spend planning their taxes. But that can be an expensive mistake! What if the IRS had a sale? What if the IRS let you discount your taxes by thousands of dollars, this year and every year to come? And what if they let you do it from the comfort of your home or your office, without lining up in the pre-dawn hours of a chilly November morning? Would you give thanks for a sale like that? You’re probably not holding your breath for the scrooges at the IRS to hold a “sale.” The good news is, you don’t have to wait for that to happen. You just need a plan. Tax planning is the key to paying the legal minimum. And a good tax plan can pay for a holiday season full of gifts and fun. Now is the season to find the mistakes and missed opportunities that may be costing you thousands. “Black Friday” tax planning before the year end can save thousands more off your taxes in the future. There are 31 days left for "Black Friday" tax planning. Contact us for ways to save on your taxes before the end of the year.  Many say that Friday the 13th is an unlucky day and today may be one of those days for taxpayers. It would appear that the IRS is playing the role of Jason Voorhees and are performing an all out massacre on the many tax deductions individuals and small business owners rely on to save money on their tax returns. Here are 13 (unlucky) tax deductions that the IRS will slaughter like Jason did the kids at Camp Crystal Lake by year end.

Don't want to be caught by the slashing machete of the IRS? Now is the time to put a plan in action so you will still be alive when the credits roll at the end of 2013. Time is ticking... See how much time you have left here.  The Internal Revenue Service has modified its “first time abate” or (FTA) policy, which provides a one-time consideration of penalty relief, based on the taxpayer’s compliance history. The FTA penalty relief option for failure to file, failure to pay and failure to deposit penalties, under certain conditions, does not apply if the taxpayer has not filed all returns and paid, or arranged to pay, all tax currently due. For example, the taxpayer is considered current if they have an open installment agreement and are current with their installment payments. The FTA relief only applies to a single tax period for a taxpayer, and penalty relief under the first time abatement provision does not apply to returns with an event-based filing requirement. Additionally the FTA relief does not apply to the following type returns if a previously filed return was late:

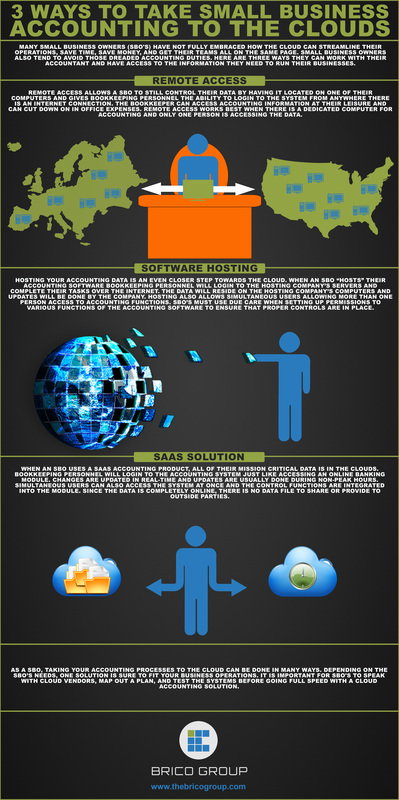

Feel free to contact us if you need assistance with a tax penalty abatement or proactive tax planning. Small business owners that are hearing a great deal about the cloud lately may not have all the facts when it comes to accounting in the cloud. Here is an infographic we created to outline the three major ways to take your accounting to the clouds.

In an attempt to reduce the administrative, recordkeeping, and compliance burdens of taxpayers, the IRS has offered a safe harbor method to compute the allowable deduction for the business-use portion of the home. The safe harbor method is effective for taxable years beginning on or after January 1, 2013.

Under the safe harbor method, the taxpayer multiplies the allowable square footage of the home office by the prescribed rate of $5.00. The allowable square footage for business use cannot exceed 300 square feet; thus, the maximum allowable home office deduction under the safe harbor method is $1,500. The safe harbor deduction, cannot exceed the business income for the year reduced by business expenses unrelated to the dwelling unit. Any taxpayer using the safe harbor method may not carry over any disallowed safe harbor deductions to the next year. Other Provisions

It’s not time to stop thinking about taxes and strategic tax planning opportunities during the tax "off" season. Since the start of 2013, there have been many new federal tax developments, which will impact tax planning for this year and beyond. As 2013 unfolds, many changes made to the Tax Code by the American Taxpayer Relief Act of 2012 (ATRA) take effect. Additionally, there are new taxes to take into account because of the health care reform package, along with enhancements to many tax credits and deductions. Here is a brief review of the tax and health care provisions affecting taxpayers for 2013. Tax Provisions

Health Care Provisions

Limit deduction for health insurer’s executive compensation to $500,000 Now is a good time to revisit these developments and explore how they will affect your strategic tax plans. Planning today can help maximize your tax savings going forward. There will be a late start to the tax season for many taxpayers as we already know due to the fiscal cliff legislation that was past at the end of 2012.

The IRS announced yesterday that it will begin accepting many of the tax returns that were affected by the last minute legislation by January 30th. There are however, additional forms that will need to be updated and for those taxpayers tax season may not start until late February or early March! Want to know if you are one of the late filers??? You are if you have to file the following forms:

Still unsure? Contact us. Source: http://www.irs.gov/uac/Newsroom/List-of-IRS-forms-that-1040-filers-can-begin-filing-in-late-February-or-into-March-2013 The IRS Tax season is upon us. Listen to this brief podcast (boo) on what forms the IRS is accepting for E-file as of Jan. 7th. The filing season for personal taxpayers will still more than likely be delayed due to the fiscal cliff legislation. We will keep you posted.  By now, of course, you've heard that Congress has passed legislation avoiding the tax increases of the Fiscal Cliff. Here are the highlights: The Bush tax cuts are restored for income up to $400,000 ($450,000 for joint filers). Rates for income above those ceilings rises to 39.6% for ordinary income. Capital gains rate…or gains you earn from the sale of property that you’ve held for longer than a year increased to 20%. The key point here is that you don’t pay tax until you actually sell the property. Next, are “qualified corporate dividends.” The rate also is 20% Corporate dividends are also subject to the new “Unearned Income Medicare Contribution” that goes into effect on January 1. New rates on capital gains and qualified corporate dividends will make tax planning an even more important part of your overall financial planning. Back in 2010, Washington cut the payroll tax by 2%, for one year, on the employee side. This meant a savings of up to $2,136 for someone earning at or above the Social Security wage base. Earlier this year, Washington struggled to extend it through 2012. But as it stands now, that cut expires. And unfortunately, it looks like both sides are content to let that cut expire for good. The Alternative Minimum Tax, or AMT, is a parallel tax designed to prevent “the rich” from using regular deductions to avoid tax entirely. The Alternative Minimum Tax is finally indexed for inflation, meaning Washington won't need to "patch" it every year so about 33 million tax payers are safe. Next, the estate tax… The estate tax "unified credit" amount that you can bequeath tax-free remains at $5 million, indexed for inflation. The actual rate rises from 35% to 40%. The legislation also extends several popular tax breaks, like higher limits for business equipment expensing, deductions for student loan interest, and tax-free charitable gifts made directly from Individual Retirement Accounts. We realize you've already heard this news. But we want you to know we'll be studying the new law in the coming weeks and months to look for every opportunity to help you save. And of course, if you have any questions, don't hesitate to call us. |

AuthorVarious contributors Archives

January 2024

Categories

All

|

RSS Feed

RSS Feed