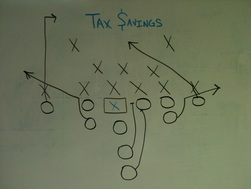

If procrastination were the Super Bowl, many small business owners (SBO's) would have multiple "Lombardi" trophies. Time to put away those whites (unless you are Billy "White Shoes" Johnson) and pull out the ole playbook of late summer early fall tax planning ideas. Just like the start of the NFL football season brings teams a new playbook, SBO's need to update their tax strategy playbooks now to ensure that they will be ready for the tax planning season starting now. Most SBO's can take a look at their previous season's record to give them an idea of how good their tax playbook was and where they need to be this year. If you have not "completed the 2013 tax season" yet, here are some of the more important "game" dates in the coming months where many SBO's can complete the 2013 tax season. • September 15th - Tax extension deadline for C-Corps, S-Corps and Partnerships • October 15th - Tax extension deadline for personal tax returns • December 31st - Final day of tax planning for 2014 season If you have completed the 2013 tax, great, but this is not the time to sit back on your laurels! Time is now to focus on new tax plays for the 2014 season. The tax league’s “Front Office” is making quite a few rule changes this year that may make it difficult for SBO’s to score many tax savings touchdowns (expiring tax provisions for SBO’s), but the basic rules are still in effect. Since the season is shorter than the NFL one, tax planning is key to saving your small business thousands. Using legal "black letter" tax strategies in your playbook will ensure you have a winning record this season. Need help devising your tax strategy playbook, feel free to contact us.

0 Comments

There is a tax firm out there that can help their clients pay no income tax. This tax firm is comprised of a large work force that has access to all the necessary technology tools and tax information to ensure that their clients use all the legal loopholes to bring their tax liability to zero and many times a surplus. This tax firm is so good at saving their clients tax dollars that major accounting firms even loan their employees to them! Sounds like a great accounting right? Only one problem this accounting firm has one client...and that client is GE. GE's Tax department is one of the most prestigious tax firms in the country. A quick Google search of "GE Tax Department" shows the efforts that GE goes through to pay no taxes. Most small business owners don't have the resources and time to research the tax strategies like their "Big Boy" counterparts. They then go about taxes much the same way most personal taxpayers do, taking the last minute "SALY" approach. Learn more about "SALY" here. Approaching taxes as a routine is ok, if your routine is done on a consistent basis. But even a consistent routine has small changes. Take your morning routine for instance. You may get up at the same time every day, but is the same song playing when you wake, or do you have the same breakfast every morning? The same goes for your tax planning routine. There is a consistent guide that you follow, but you must always monitor for the changes. This includes staying up to date on tax changes, and how they affect your business decisions during the year.

There are quite a few tax issues affecting small businesses currently. From the changes in depreciation, and deduction rules to healthcare now is the time to take advantage of tax strategies for main street businesses like yours. It's doesn't take having a large tax firm as your tax department to save your hard earned money, but it does take some work (with a little help from a tax expert friend like us :-). So do like "Nike" the Goddess of motivation/implementation and "just do it".  As the Independence Day 4th of July celebrations are being finalized for later this week, I got to thinking about the feeling I had as an entrepreneur the day I claimed independence from the typical route and set out on my own destiny. Being an entrepreneur can provide a person with the ability to be independent but that can be both an asset and a liability. On the one hand you get to make all the decisions. Many of those decisions are made however with either little to no knowledge of the situation or the effects of those choices made (especially in the early stages of a business). Typically when decisions are made in this manner, a setback (or as some would call it a learning experience) occurs. We have learned, from taking a look back at history, the main reason we celebrate Independence Day is due to the tax burden placed on American colonists by the British. Taxes have always caused many small business owners grief. In a recent report by Paychex, a leading payroll provider; 47% of small business owners ranked taxes as the largest issue impacting them in 2014. If that includes you, then now is the time to claim your tax independence. So in between the plates of hot dogs, ribs and watching the fireworks, download the "Tax Independence Survey" below and stop making the expensive tax mistakes that keep many entrepreneurs and small businesses worried about their tax future. The survey focuses on key areas of your life (business and personal) where there may be tax savings that you can use to celebrate more holidays (maybe Christmas in July) with your family. Then after the holiday contact us so we can begin implementing some of the tax strategies. We hope you have a safe and happy Independence Day 4th of July celebration.  Many say that Friday the 13th is an unlucky day and today may be one of those days for taxpayers. It would appear that the IRS is playing the role of Jason Voorhees and are performing an all out massacre on the many tax deductions individuals and small business owners rely on to save money on their tax returns. Here are 13 (unlucky) tax deductions that the IRS will slaughter like Jason did the kids at Camp Crystal Lake by year end.

Don't want to be caught by the slashing machete of the IRS? Now is the time to put a plan in action so you will still be alive when the credits roll at the end of 2013. Time is ticking... See how much time you have left here.  The Internal Revenue Service has modified its “first time abate” or (FTA) policy, which provides a one-time consideration of penalty relief, based on the taxpayer’s compliance history. The FTA penalty relief option for failure to file, failure to pay and failure to deposit penalties, under certain conditions, does not apply if the taxpayer has not filed all returns and paid, or arranged to pay, all tax currently due. For example, the taxpayer is considered current if they have an open installment agreement and are current with their installment payments. The FTA relief only applies to a single tax period for a taxpayer, and penalty relief under the first time abatement provision does not apply to returns with an event-based filing requirement. Additionally the FTA relief does not apply to the following type returns if a previously filed return was late:

Feel free to contact us if you need assistance with a tax penalty abatement or proactive tax planning. |

AuthorVarious contributors Archives

January 2024

Categories

All

|

RSS Feed

RSS Feed